Ma passion pour

le CBD

Quelle est la meilleure façon d’acheter des produits CBD en ligne ?

On en parle sur le Blog

Ce que vous devez savoir avant d’acheter un produit CBD dans une boutique en ligne

- Comment utiliser la cigarette électronique pour arrêter de fumer – Conseils et bénéfices

- Est-ce que le CBD est un Anti-douleur ?

- Quel est le meilleur moment pour prendre du CBD ?

- Est-ce que le CBD est en vente libre ?

- Où se procurer du CBD ?

- Quel est le prix d’un flacon de CBD ?

- Quand ne pas prendre du CBD ?

- Quel CBD pour dormir ?

- Ou acheter du CBD en France ?

- Comment se prennent les gouttes de CBD ?

- Pourquoi pas de CBD en pharmacie ?

- Est-ce que le CBD est dangereux ?

- Quel CBD arthrose ?

- Quel est le prix du CBD en pharmacie ?

- Comment se faire rembourser le CBD ?

- Est-ce que le CBD se vend en pharmacie ?

- Est-ce que le médecin peut prescrire du CBD ?

- Qu’est-ce que le CBD vendu en bureau de tabac ?

- Quel CBD choisir ?

- Qui peut acheter du CBD en France ?

- Quel est le meilleur moment pour prendre l’huile de CBD ?

- Est-ce que le CBD fait dormir ?

- Est-ce que le CBD est remboursé par la sécurité sociale ?

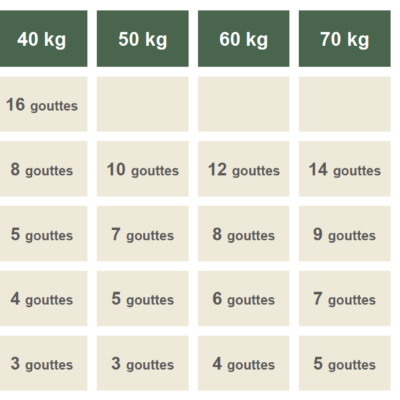

- Combien de gouttes de CBD par jour ?

- Quel est le CBD le plus efficace ?

- Quel est le prix du CBD en bureau de tabac ?

- Est-ce que le CBD est en vente libre ?

- Quel médecin prescrit du CBD ?

- Comment se faire rembourser le CBD en France ?

- Quel CBD pour douleur ?